The Bicycle Association and SMS INC. publish their first Market Data Bulletin

September 30, 2019

The Bicycle Association (BA) has published its first monthly MARKET DATA BULLETIN, nicknamed “The BA Barometer” by some of its founding supporters.

The fact-filled circular, which covers insights for the period January 2018 to July 2019 and is based at this stage on around 35% of the market, comes ahead of the on-line portal launch, which is due to go live before the end of 2019.

The service is being managed on behalf of the BA by SPORTS MARKETING SURVEYS INC. (SMS INC.), whose system now has over 300,000 products on the database. SMS INC. are responsible for data validation and importing new retailers who join the programme.

Each month until launch, the BA will provide a FREE high-level analysis of key statistics exclusively to retailers who are sharing their data and to brands signed up to the service.

Over 400 participating UK cycle businesses now know the latest information about UK cycling market consumer buying trends. These include IBDs, brands, importers, distributors, online specialists and national chains. All participating businesses received the report on Friday 27th September.

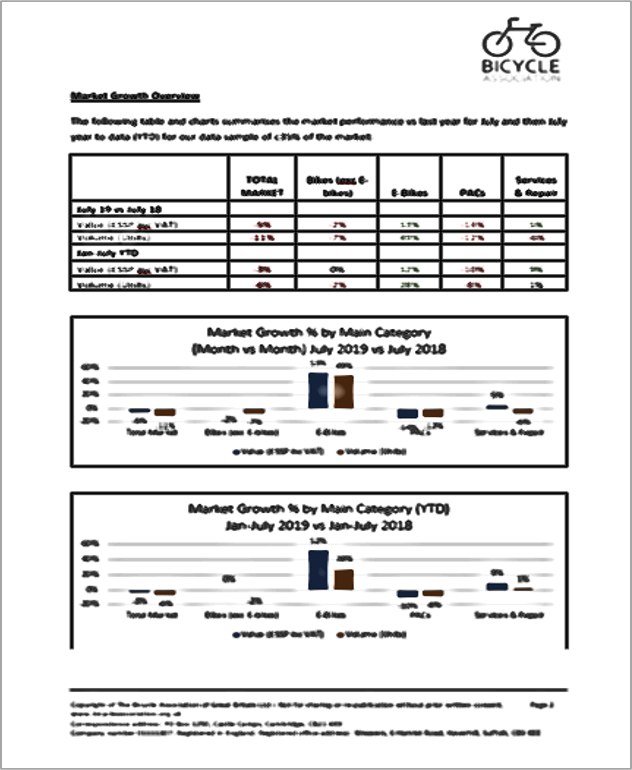

Positioned as an “initial findings” report, the 37 key numbers outline the overall state of the market and growth, broken out across four main categories: Bikes, E-bikes, Parts/Accessories/Clothing (PACs) and Services/Repair.

Headline data reveals a relatively tough market overall for cycling during July with value sales down 5%, which is perhaps not surprising given the weather was slightly cooler and considerably wetter compared to July 2018, and given the potential impacts of Brexit uncertainty, general consumer confidence etc. This means year-to-date market value is now down 3%.

If you aren’t signed up to the Market Data Service here’s some of what you missed:

Total market value and volume growth for July and year to date

Market growth by category (Bikes/E-Bikes/PACs/ Servicing)

Category growth dynamics by bike sub-category (Mountain, Road, Commute, Gravel, Cross, Folding, BMX, Kids, TT)

Category growth dynamics by e-bike sector (Mountain, Road, Commute, Gravel, Folding)

The report highlights which sub-categories of bikes were growing or declining in sales, and breaks down which sub-categories of e-bikes were enjoying the strongest growth. It also outlines further trends for PACs and Services & Repair.

Steve Garidis, Executive Director of the Bicycle Association, commented:

Even this early circular offers more real, data-derived insight than the UK industry has ever had before. It rather blows out of the water any sense you can rely solely on bike import statistics to tell you where the market is right now.

Import stats can, with many caveats, suggest an overall direction of travel of market size, but when it comes to a deep understanding of actual consumer buying behaviour, live EPOS data anonymously streamed to a central point and curated by professional data handlers and market researchers is delivering stunning clarity and insight.

It’s night and day – like going from navigation by compass, to using a GPS.

The BA have scheduled the release of their second bulletin, including August data, for October and plan to coincide the release with their Annual Members’ conference in London on the 10th October.

John Bushell, Managing Director of SMS INC. commented:

The Market Data Service is a substantial programme and very important initiative for the industry. This first release is just a top line overview of what is a very granular monitor of the market and its retail performance.

Our team has been working closely with the BA and with multiple retailers for 18 months to structure and compile the data for what is one of the most complex sports markets in the UK. We’re delighted to see the first BA Bulletin go out to supporters.

The BA’s Simon Irons, who has been leading the project from the outset, commented:

The type of information that users will be able to mine is incredible and the results we’ve seen so far are already challenging many assumptions. So, for example, from a smaller sub-set of the data we’ve collected, we now know that e-bike sales value is growing faster than e-bike unit volumes which means that the average price of an e-bike is rising. That was interesting, but not a huge surprise.

Just for a bit of fun, I asked a couple of colleagues to guess where they thought that average price rise was coming from?

They correctly picked the category with the highest average price but that had been pretty stable this year, whereas the price growth was coming from a combination of 3 other categories.

I think they both have a New Year’s resolution coming on: listen to your gut, but always check what the data says.

The Market Data Service is free for every independent retailer in the UK who provides cycling retail data, whether or not they have an EPOS system. Presently the system accepts data automatically from four EPOS providers (Ascend, Abacus, Citrus Lime, and Seanic) with discussions ongoing with others that should see greater automated access going forward.

For those retailers with a bespoke IT system or no EPOS till at all, this doesn’t present a barrier as the Market Data team can work with a variety of different formats and for those with no EPOS, a monthly “self-reporting survey” covering 12 simple questions allows any retailer to take part.

Independent bicycle dealers who would like to receive Septembers’ free report, and future editions, can sign up to the Market Data Service right away. Anyone providing data on a monthly basis and signing up to the Market Data Service will also automatically get a login to access the “Interactive Dashboard” when it goes live.

To get your free MARKET DATA BULLETIN you can sign up to the service at:

https://www.bicycle-association.org.uk/market-data

or call the Bicycle Association helpline on 0203 857 4411.